We use cookies to ensure that we give you the best experience on our website.

By using this site, you agree to our use of cookies. Find out more.

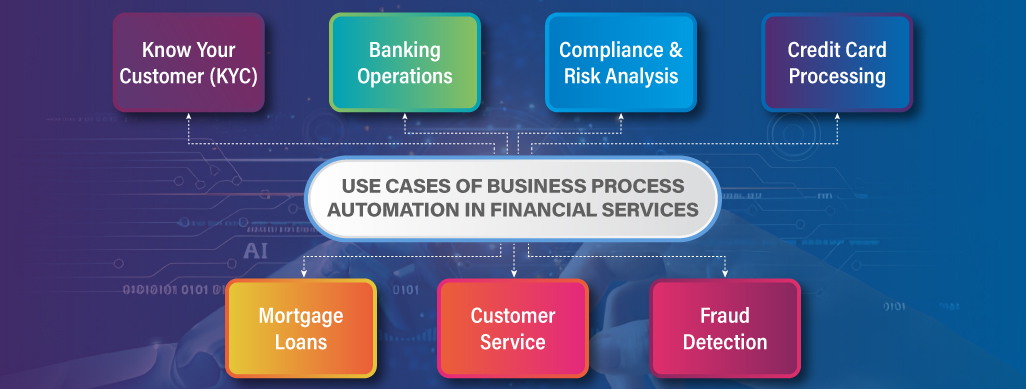

This blog discusses 7 key use cases of BPA and how it provides benefits like cost savings, faster turnaround times and better regulatory compliance.

Business process automation has revolutionized operations in the financial services sector. Technological advancements have enabled banking and insurance companies to deploy robotic process automation (RPA) to streamline workflows and enhance efficiency. This blog discusses 7 key use cases of BPA and how it provides benefits like cost savings, faster turnaround times and better regulatory compliance.

We will first explore what Business process automation BPA is and then examine in detail how processes such as KYC, mortgage lending, fraud detection and more are benefiting from automation. The goal is to illustrate how financial organizations can leverage this transformative technology to boost productivity and deliver superior customer experiences.

Business process automation refers to the application of technology to automate routine and repetitive tasks and workflows within an organization. By deploying robotic process automation (RPA) tools and software bots, enterprises are able to configure digital workers that can perform high-volume data entry, processing, record-keeping and transaction-related activities much faster and at a larger scale than humans.

These software robots are programmed to interact with different systems like desktop applications, backend databases and web portals just as humans would to complete tasks. They capture pre-defined business rules and processes to automate standard operating procedures. This allows companies across industries to streamline business processes, reduce errors, cut costs and improve productivity through simulated human-led task execution in a rule-based automated manner at any time of the day.

Here are some of the key ways that automation helps the finance industry:

One of the major ways that business process automation delivers value to the finance industry is through significant cost reduction. By leveraging robotic process automation (RPA) technology, financial organizations can eliminate many repetitive manual tasks that were previously handled by human employees. This allows the institutions to reduce headcount needs for roles like data entry clerks, back-office processors, and customer service agents.

When tasks like paperwork handling, data processing, record-keeping and basic transaction services are automated, the labor expenses associated with these activities can be avoided entirely. For large banks and insurers that process enormous volumes of transactions and customer requests daily, the resulting cost savings from automating even a small percentage of work through business process automation services can amount to millions of dollars annually. This frees up capital that can be reinvested in strategic initiatives, product development and improving services to better serve customers.

Automation allows financial institutions to greatly accelerate various operational processes. When manual tasks are automated using robotic process automation (RPA), transactions and other workflows can be completed much faster. For example, automated financial tasks like new account openings that may have taken days to finalize manually can now be executed instantly through digital onboarding.

Similarly, back-office operations such as money transfers, payments, verifications and reconciliations see significant time reductions. This faster turnaround across business functions has wide-ranging benefits. It improves response times, shortens wait times for customers, enables near real-time processing, and maximizes throughput. With automation augmenting the workforce, banks and insurers are able to handle higher transaction volumes during peak periods while maintaining quick turnaround service levels. Overall, speeding up operations enhances efficiency, customer satisfaction and competitive positioning.

Financial institutions have made substantial investments in developing robust IT systems to support their digital operations. Business process automation allows them to leverage this existing technology footprint more effectively.

By integrating RPA tools into the pre-existing infrastructure like core banking platforms, loan origination systems, CRM software and payment gateways, organizations can extract additional value from these sizable prior IT investments. Automating workflows helps optimize the use of systems that may have been underutilized earlier. This means financial enterprises do not need to deploy brand new technology applications when adopting automation at scale.

They can simply plug bots into available systems to enhance processes without significant additional spends. As a result, the costs of automation can be contained while fully capitalizing on resources already in place. This makes the ROI potential of business process automation even more attractive.

One of the powerful capabilities of business process automation services is the ability to process large volumes of data in real-time. By integrating robotic process automation (RPA) bots with data extraction tools, financial institutions can automate the collection, organization and analysis of data from various sources. This includes data pouring in from multiple online and offline channels around the clock.

Whereas manual processing of such massive and continuous data flows would be near impossible, RPA bots are able to capture, validate, transform and load incoming transaction records, customer info updates, payments records and more in real-time. This allows banks and insurers to gain valuable insights based on the latest information available. They can now make time-sensitive decisions, execute risk assessments and implement compliance checks instantaneously based on a single version of truth. Adopting a real-time data processing model has significantly improved outcomes across industries like credit risk management, fraud detection and digital recommendations for customers.

Implementing business process automation utilizing robotic process automation (RPA) allows financial institutions to greatly enhance the customer experience. When repetitive back-office tasks are automated, it frees up employee time and effort to dedicate towards more valuable front-facing roles.

Customer service agents can spend additional minutes on each customer interaction to provide personalized assistance. Queries are resolved faster through real-time access to account information and transactions facilitated by automation. Waits on call centers are reduced as bots handle basic requests remotely.

Digital services are also augmented through RPA, allowing 24/7 self-service options via online chatbots, AI assistants and automated workflows. This multi-channel support infrastructure powered by automation leads to faster issue resolution, greater convenience and higher customer satisfaction. In the highly competitive financial sector, a superior customer experience is a key driver of loyalty, advocacy and growth.

Here are some key use cases of business process automation in the financial services sector:

One of the major use cases of automation in financial services is Know Your Customer (KYC) compliance. The KYC process, which involves verifying customer identities and screening them against sanctions lists, is traditionally a very lengthy and paperwork-intensive task. By automating identity verification, document processing and screening, banks are now able streamline their KYC workflows significantly.

Automation tools deploy technologies like optical character recognition, AI and machine learning to extract data from documents, verify IDs and screen customers against watchlists instantly. This has not only accelerated onboarding times but also ensured compliance by standardizing checks and removing human errors.

Banking operations such as processing deposits, withdrawals, customer inquiries, account transfers, loan disbursements etc. involve high volumes of repetitive administrative tasks. To reduce turnaround times and free up employees for more strategic work, many banks are leveraging business process automation services which deploy bots and artificial intelligence.

These services automate mundane back-office processes through robotic process automation, optical character recognition and machine learning. As a result, tasks like data entry, record updates, payment processing and reconciliations that previously required human intervention can now be performed digitally at much higher speeds and accuracy. This has significantly boosted productivity and efficiency across banking operations.

Maintaining compliance with constantly evolving regulations and detecting emerging risks in a timely manner is crucial for financial institutions. However, manual compliance processes are resource-intensive and prone to errors. Business process automation services are now helping banks overcome this challenge.

By automating workflows using robotic process automation, these services allow banks to continuously monitor vast pools of transaction data, regulatory changes and sanctions lists. They can intelligently identify any exceptions or suspicious patterns through machine learning algorithms. This automated approach has enabled more agile and accurate compliance checks and risk analysis. As a result, banks save costs while mitigating compliance and risk management risks.

Automation is revolutionizing various aspects of credit card processing for banks and financial institutions. Using robotic process automation, credit card applications that once required human data entry can now be digitally filled and verified. Payments made by customers are instantly recorded through automated reconciliation.

Bots additionally help resolve customer disputes and queries faster. Machine learning aids in real-time fraud detection during payment authorizations. This has significantly cut down application and payment processing times. Customers enjoy a seamless digital experience while banks boost operational efficiency through batch job automation, self-healing workflows and streamlined compliance monitoring for credit cards.

The mortgage loan process is highly manual, paperwork-intensive and time-consuming. However, automation is changing this dramatically. Using robotic process automation, lenders can now digitally gather customer documentation, verify incomes, pull credit reports and check property values - all with little human intervention.

Eligibility checks, underwriting and approvals are also being automated. This has led to faster turnaround times, from application to disbursal. Customers benefit through a more hassle-free digital experience. Lenders gain significant efficiency as bots provide a centralized processing dashboard for agents. Automation thus improves the overall mortgage origination process while freeing up staff to focus on advisory roles.

Automation is playing a big role in enhancing customer service experiences for banks and improving response times. Chatbots and virtual assistants handle a high volume of basic customer queries and requests through conversational interfaces. They operate 24/7 and can quickly retrieve standard information to resolve customer issues. This reduces wait times significantly.

For complex queries, bots collect case details and seamlessly transfer calls/chats to available agents. Furthermore, automation allows customers to simulate services digitally and track application status remotely. As a result, financial institutions have achieved higher customer satisfaction scores while lowering their service costs through conversational AI and self-service options.

Fraudsters are constantly devising new techniques, so banks need innovative ways to protect customers. Automation and artificial intelligence are proving effective for fraud detection. Machine learning models analyze vast volumes of transaction records and exception alerts to spot patterns that may indicate fraudulent activities in real-time. Rules-based algorithms also automatically screen transactions against known fraud scenarios.

Any doubtful transactions are flagged for immediate investigation without human intervention. This has enabled banks to identify suspicious activities much faster. Automated fraud detection integrates well with banks' existing security systems too. Overall, it helps financial institutions curb fraud losses and enhance the security of digital payments.

In conclusion, business process automation has become a priority for financial institutions seeking to future-proof operations and gain competitive advantage. The 7 use cases discussed demonstrate how automation can optimize core functions across banking, lending, insurance and other verticals. Whether it is accelerating transactions, strengthening controls or improving service quality, the ROI from properly implemented RPA initiatives is significant.

As technologies advance further with AI, machine learning and computer vision, the potential for automation within finance will continue expanding. Adopting a digital-first strategy backed by automation will be critical for organizations to navigate disruption and changing customer dynamics in coming years. The time is now for financial enterprises to ramp up their BPA capabilities.

Leave a Comment

Your email address will not be published.