We use cookies to ensure that we give you the best experience on our website.

By using this site, you agree to our use of cookies. Find out more.

AI is poised to play a pivotal role in reshaping insurance management landscapes over the coming year. While concerns around data privacy and bias will need addressing, responsible use of technology promises to deliver hyper-personalized offerings and efficient services.

As we reach the end of 2023, Artificial Intelligence has profoundly transformed many industries over the past couple of years. The insurance sector is one of the areas that has increasingly embraced AI solutions to optimize processes and enhance customer experience. With growing volumes of policy, claims and risk data, insurers now have immense opportunities to apply advanced analytics and machine learning to streamline operations. In this blog, we will discuss how AI technologies could further evolve by 2024 to automate insurance management workflows and add value at different touchpoints.

Artificial Intelligence refers to the use of advanced computational technologies to perform tasks normally requiring human intelligence, such as visual perception, decision-making, and language translation. In the insurance sector, AI involves using algorithms and vast amounts of data to analyze policies, claims, risks, and automate routine operations. Many insurance companies have been adopting AI solutions to improve key areas of their business from underwriting and claims management to predicting customer churn.

At its core, AI relies on machine learning algorithms that can learn from large datasets without being explicitly programmed. For insurers, this involves training algorithms on past policies, customer profiles, claims data, loss estimates and more. As more data is fed into these models, they get better at recognizing complex patterns and relationships.

For instance, AI models can learn that customers from a specific geographic location with prior health conditions are more likely to file certain types of claims. They can also determine the exact factors that increase risk of accidents for autonomous vehicles. Such data-driven insights allow insurers to price policies accurately, streamline underwriting, automate simple claims, detect fraud and better serve policyholders.

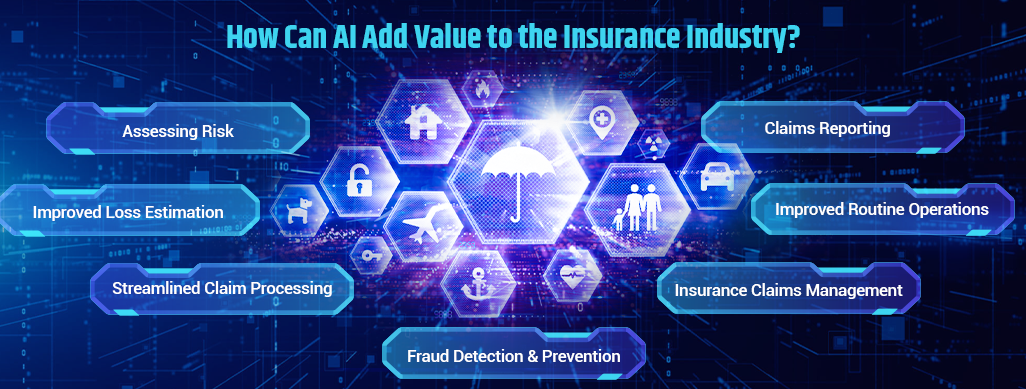

AI has the potential to significantly boost productivity and operational efficiency within the insurance industry. As data volumes continue to grow, Artificial Intelligence tools are able to sift through vast amounts of information and uncover valuable patterns that humans may miss. This ability allows AI to add value across underwriting, claims processing, customer service and more. Some of the key ways AI can add value include:

AI has great potential to streamline the claim processing workflow and significantly reduce claim resolution timelines. By leveraging techniques like natural language processing, AI bots developed by top Mobile App Development Company can extract key information from claimant conversations or documents and automatically populate digital claim forms. Computer vision capabilities allow photos/videos of damage sent from claimant mobile devices to be analyzed for insight.

Pattern recognition and automated validation of claims against policies can then enable immediate inspection assignment or preliminary approval of straightforward claims. With AI assuming repetitive rule-based tasks, insurance agents can devote more time on complex claim assessment, thereby improving staff productivity and enhancing customer service levels through faster claim settlements.

AI is allowing insurers to more accurately assess risk by analysing massive amounts of customer and claim data. Using advanced algorithms, machine learning models developed by experienced Mobile App Development Company can identify hidden patterns between numerous risk factors and actual claim experiences.

By taking into account customer attributes like age, location, profession, health conditions and also lifestyle parameters from mobile usage and social media footprints, AI can dynamically segment risk profiles and calculate individualized premiums. This helps insurers price policies more precisely based on inherent risks. It also benefits lower-risk policyholders with competitive rates. Over time, as AI systems learn from more data, the ability to assess unique customer risks will continue enhancing underwriting precision.

AI is proving to be a powerful tool in the fight against insurance fraud. Using technologies like machine learning and neural networks, Artificial Intelligence solutions developed by leading Mobile App Development Company can analyze policy documents, claims applications, medical records and payment patterns to identify anomalies, inconsistencies and red flags.

By tracking suspect behaviors and spotting common traits among fake claims over time, AI improves fraud detection accuracy. Moreover, AI-enabled predictive analytics can also help insurance providers recognize higher-risk customer segments and claims in advance. This enables proactive steps to be taken to verify claims details before payouts are approved, minimizing losses from fraudulent activities.

AI can significantly enhance and streamline the claims reporting process. Using natural language processing and computer vision capabilities, Artificial Intelligence systems can parse written or audio claim descriptions as well as images/videos of damage or injury submitted by customers through mobile apps and web portals.

Relevant data is then automatically extracted and used to pre-fill digital claims forms. This provides a seamless digital claims reporting experience for customers around the clock from any location. With most of the heavy data entry work done by AI, insurance agents can focus on validation, verification and addressing customer queries, resulting in higher efficiency, faster processing and improved customer satisfaction indices.

AI has great potential to optimize insurance claims management and investigations. Powerful AI technologies like machine learning and predictive analytics allow insurers to identify claims patterns, red flags and predict risks. This helps triage claims effectively. By analyzing policy clauses, medical reports and other past claim details, AI assistants can also automate routine tasks like determining liability and assessing damage extent.

This frees up adjusters to focus on complex claim scenarios. Additionally, AI is helping expand the scope of remote claims inspection using drones and satellites. This makes the investigation process more efficient while reducing overhead costs. Overall, AI applications are augmenting human efforts in streamlining end-to-end claims handling.

Artificial Intelligence is automating numerous back-office tasks and processes to enhance operational efficiency. Using optical character recognition, natural language processing and other technologies, insurance policies can be digitized and important data fields populated automatically.

Robotic process automation solutions developed by leading Mobile App Development Company then help streamline clerical work like data entry, document processing, record keeping and basic underwriting. This allows insurers to redeploy staff to higher-value activities such as product innovation, customer service and claims management. By freeing up resources from mundane chores, AI enables insurance providers to improve turnaround times and compliance with routine operational tasks.

AI and machine learning algorithms developed by expert Mobile App Development Company are enabling more precise loss estimation in the insurance industry. By leveraging data from past claims including policy specifications, accident details and final payout amounts, AI models can identify complex relationships between various contributory factors.

This helps provide faster and more accurate simulated estimates upfront for different loss scenarios based on policy coverage. Over time, as AI systems ingest more real-world data, loss prediction abilities continue enhancing. More uniform loss estimation allows insurers to appropriately price risks and settle claims efficiently. It also ensures consistent policyholder experiences and benefits settlements.

As AI technologies continue to evolve at a rapid pace, the role of artificial intelligence in insurance management is expected to grow significantly in the coming years. Some trends that will likely shape the future include:

AI is poised to play a pivotal role in reshaping insurance management landscapes over the coming year. While concerns around data privacy and bias will need addressing, responsible use of technology promises to deliver hyper-personalized offerings and efficient services. The COVID-19 pandemic has also fast-tracked digital transformation across industries. If leveraged strategically, AI could help insurance companies emerge stronger from challenging business environments through optimized processes, cost savings and enhanced customer relationships. Exciting times lie ahead as artificial intelligence progressively transforms this important sector.

Leave a Comment

Your email address will not be published.